Discover the straightforward steps to setting up your own Accountancy Corporation in California. This guide walks you through the essential legal and tax choices, getting registered, and keeping compliant with state rules. With a little help from a California Incorporation Attorney, you'll be on your way to running a professional, legally sound accountancy practice, ready to serve your clients effectively.

by Zach Javdan

October 23, 2023

Are you a certified accountant in California running your own practice, and looking to save on taxes while limiting your liability? If so, forming a California professional corporation, specifically a California accountancy corporation, might be a good move for you.

By having your accountancy corporation taxed under subchapter S of the Internal Revenue Code (as an S corporation), you could benefit from significant payroll tax savings.

Other advantages of forming a CA accountancy corporation include business continuity and an enhanced professional image.

Although an accountancy corporation won’t protect you from professional malpractice claims, it can be helpful for other types of legal issues. For instance, claims made by employees or in case of contractual disputes.

It’s important to consider the following factors when starting an accountancy corporation in California. Failing to do so could lead to problems like invalidation of your entity if a lawsuit or audit comes your way.

Taking the DIY route in forming an accountancy corporation can be tempting for many accountants.

Yet, this approach can stumble at the registration stage, as the paperwork needed for validation with the California Board of Accountancy can be tricky terrain.

Why not channel your time into what you do best and leave the registration legwork to a seasoned professional in California business formation?

It’s crucial to team up with an incorporation attorney with a solid history of setting up corporations for accountants.

Engage in thorough discussions on critical aspects like official formalities, tackling liability, tax considerations, the timeline, and more.

If the idea of a hassle-free setup for your entity by a California business formation specialist appeals to you, reach out to us at (310) 765-2525 or initiate the process online securely.

Is it wiser to hold off until the new year if you’re looking to form an accountancy corporation in November?

Would forming the incorporating pursuant to California’s 15-day-rule be beneficial?

Such queries are crucial and warrant a good discussion with the business formation specialist you collaborate with.

Accountants are prohibited from using LLCs, for practicing accounting, pursuant to California Corporations Code §17375.

This statute restricts accountants, and most other licensed professionals, from using a Limited Liability Company (LLC) in association with their license.

Accountants are required to specifically use professional accountancy corporations which are certified by the California Secretary of State and registered with the California Board of Accountancy.

When forming an accountancy corporation in California, ensuring the right organizational structure is key.

Here’s how the roles are distributed based on the number of shareholders under California Corporations Code section 13403:

Single Shareholder Scenario : When there’s only one shareholder, this individual takes on the roles of the director, president, and treasurer of the corporation.

Two Shareholder Scenario : In the case of two shareholders, they both serve as directors, and among them, they share the positions of president, vice president, secretary, and treasurer.

Share Issuance : In California, accountancy corporations are structured in a way that primarily licenses holders in the field of accountancy are allowed to be shareholders. However, under certain conditions, non-licensees can also hold shares. These non-licensees must actively engage in the firm’s operations and must constitute a minority of the ownership, with the exception being a firm with only two shareholders, where one can be a non-licensee.

When applying for initial licensure and during license renewal, it is mandated per CCR, Title 16, section 51 that firms with non-licensee owners certify that any non-licensee owner, whose principal place of business is in California, is informed of the professional conduct rules applicable to accountancy firms. This certification requires a declaration signed by a licensed shareholder during the firm registration application process.

Furthermore, according to BPC section 5154, shareholders who are CPAs or PAs need to have a valid license to practice public accountancy. If a shareholder or employee is an out-of-state CPA wishing to practice in California, they must fulfill certain licensure requirements as outlined in BPC sections 5087 and 5088, as well as CCR, Title 16, section 21, prior to practicing within the state.

To obtain a Certificate of Registration from the California Board of Accountancy (CBA), an accountancy corporation must have at least one shareholder with an active California CPA/PA license. While the director of the firm must be a licensed shareholder, a non-licensee is allowed to be a shareholder, vice-president, or secretary (officer) of the corporation. However, a non-licensee cannot simultaneously be a shareholder and an officer, and is also not permitted to be a director of the firm.

Ultimately, this structured setup ensures that the corporation operates under the expertise of licensed professionals, which is crucial for maintaining the high standards of accountancy practice in California.

Buy-Sell agreements (also referred to as shareholder agreements) become crucial when an accountancy corporation has more than one shareholder on board.

These agreements lay down the roadmap for scenarios like a shareholder’s demise, incapacity, divorce, or decision to sell their shares to another accountant.

Neglecting to have a buy-sell agreement in place can lead to challenging situations when unexpected circumstances crop up.

Engaging a California business formation attorney can be a wise step to draft a comprehensive buy-sell agreement for your California accountancy corporation.

California professional accountancy corporations have two tax classification options.

The first route, which is the default setting, is to be taxed as a “C” corporation.

The alternative is to opt for the “S” corporation tax status.

The designations of C and S corporations are orchestrated with the IRS, while the formation of the accountancy corporation itself is done with the California Secretary of State.

Kickstarting the process begins with filing with the CA Secretary of State.

Following that, the next step is to file with the IRS.

When IRS Form 2553 is filed, the accountancy corporation is recognized as a “small business corporation,” also dubbed as “S” corporations.

C corporations stand as separate entities when it comes to tax matters. They file their own tax returns and pay their own income taxes.

On the flip side, the shareholders (owners) of the accountancy corporation file their separate tax returns, relating to the income distributed to them by the corporation, in their individual capacity.

This setup often leads to what’s widely termed as “double taxation.”

To sidestep the double taxation hurdle, owners of California accountancy corporations usually tilt towards having their corporations taxed as “S” corporations.

The allure of S corporations lies in the “pass-through” taxation feature.

The S corporation tax status is often preferred by accountants due to the payroll tax savings and avoidance of double taxation. However, it’s advisable to thoroughly analyze whether a C or S corporation structure best suits the financial goals of your accountancy practice.

Selecting a name for your accountancy corporation in California isn’t just a matter of personal preference—it’s a legal matter governed by specific regulations. Your firm’s name must comply with Business and Professions Code section 5060 and California Code of Regulations, Title 16, section 75.5.

Furthermore, a business entity identifier indicating the corporation status must be part of your firm’s name. Suitable identifiers include “Corporation,” “Incorporated,” “Corp,” “Inc,” or “Professional Corporation” as per the guidelines from the California Secretary of State.

It’s essential to ensure your desired name is available with the California Secretary of State. Have a few alternatives ready just in case. Your chosen name should reflect the services you offer and uphold the integrity of the accounting profession.

If in doubt, consult with a legal professional well-versed in California business formation regulations to ensure your chosen name adheres to all state requirements. Your name sets the stage for your professional interactions and embodies your brand’s identity. Ensuring it aligns with legal requirements and resonates with your target clientele is paramount.

Every corporation in California, including accountancy corporations, must designate an agent for service of process, also known as a registered agent. This agent needs to be available at a physical address in California from 9 AM to 5 PM on business days.

You have a few options when it comes to choosing your registered agent. One possibility is to appoint an individual from within your corporation—like an officer, director, or shareholder. However, it’s crucial to remember that if the registered agent is not present during the specified hours, and a process server comes knocking with a lawsuit, it could result in a default judgment against your corporation. That’s legal speak for the plaintiff automatically winning their case because you weren’t there to receive the lawsuit.

If being tethered to the office from 9 to 5 doesn’t sound appealing, or if you prefer an added layer of privacy, you might consider hiring a professional registered agent service. They handle all the process serving and official mail, freeing you up to focus on your clients and grow your accountancy practice. Plus, a professional service can provide an extra layer of privacy by keeping your name and office address out of public records.

So, when setting up your accountancy corporation, ensure you or your designated registered agent is available at the specified physical address during regular business hours. And if that’s not feasible, hiring a professional registered agent service is a wise and convenient alternative.

The first step in creating a California Accountancy Corporation is filing the Articles of Incorporation of a Professional Corporation with the California Secretary of State. This document is pivotal as it officially marks the registration of your corporation with the state. The details to be included in the Articles of Incorporation are numerous yet crucial for legal compliance.

Start with the name of the Accountancy Corporation, ensuring it complies with the naming guidelines set for accountancy corporations in California. Next, state the principal business address where your corporation will be operating. Mention the name and address of the individual or entity appointed as the Agent for Service of Process to receive legal documents on behalf of your corporation.

It’s also necessary to specify the number of shares your corporation is authorized to issue, representing the ownership portions of your corporation. Most importantly, clearly articulate that the purpose of the corporation is to provide accountancy services, as per California law, to avoid any misinterpretations.

Accurate completion and filing of the Articles of Incorporation are of paramount importance to lay a solid legal foundation for your accountancy corporation. Hence, consulting an attorney acquainted with California business formation regulations is advisable to ensure all details are correctly handled from the outset.

Upon successfully filing the Articles of Incorporation, it’s time to prepare the organizational corporate minutes for your accountancy corporation. This document serves to affirm the information provided in the Articles of Incorporation and takes the crucial step of appointing the corporation’s officers and directors.

These minutes are more than a mere formality. They are a vital part of the corporate records that could be scrutinized in the event of a lawsuit or audit. They provide a clear record of the corporation’s organizational structure and decision-making protocols, which can be invaluable in demonstrating compliance with California’s corporate governance requirements.

Moreover, the state of California mandates the preparation of annual corporate minutes. These yearly records chronicle the key decisions and actions undertaken by the corporation during the preceding year, forming a continuous record of the corporation’s evolution and adherence to legal protocols.

The preparation of both organizational and annual corporate minutes is an essential practice to maintain the integrity and legal standing of your accountancy corporation. Therefore, ensuring these documents are accurately prepared and securely stored is a prudent move in safeguarding your corporation’s legal and operational footing.

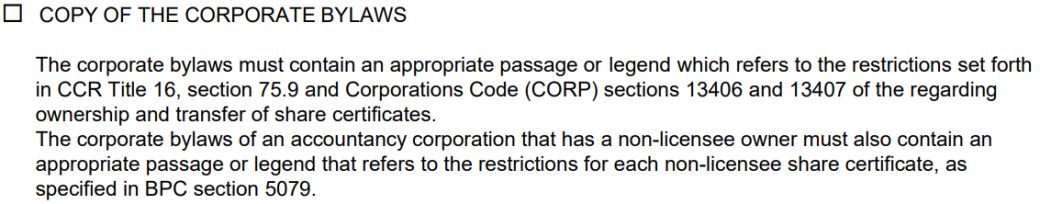

Bylaws establish the operating procedures and rules for your California Accountancy Corporation. They cover various aspects like how the corporation will be operated, where it’s located, the scheduling of shareholder meetings, powers and duties of directors and officers, issuance of stock, record-keeping, and other general matters. They are a crucial part of your corporation’s records and must be available in case of a lawsuit or an audit. Lack of bylaws could be a factor towards legal complications in case of a lawsuit.

Bylaws need to address certain restrictions concerning the ownership and transfer of share certificates, as outlined in CCR Title 16, section 75.9 and Corporations Code sections 13406 and 13407. Specifically, if your accountancy corporation has a non-licensee owner, the bylaws must include a passage or legend that refers to the restrictions for each non-licensee share certificate, as specified in BPC section 5079.

California Accountancy Corporation bylaws are often rejected by the California Board of Accountancy for having incorrect language. Via the CA Board of Accountancy.

Stock issuance is a crucial yet frequently overlooked step when forming an accountancy corporation in California. It’s how you document who owns what part of the corporation. Each shareholder’s ownership is represented by shares of stock, and it’s essential to get this part right.

Here’s the drill: stock certificates are issued to the shareholders. Each certificate should clearly spell out the corporation’s name, the shareholder’s name, the number of shares issued to that shareholder, the total number of shares authorized by the corporation, the date when these shares were issued, and bear the signatures of both the corporation’s president and secretary.

Now, California throws in a unique spin for accountancy corporations. The stock certificates also need to carry specific language concerning the ownership, sale, or transfer of shares. This isn’t just a bureaucratic nicety; it’s about ensuring that shares remain in compliant hands. The legalese should echo the restrictions laid down in CCR Title 16, section 75.9 and Corporations Code sections 13406 and 13407, safeguarding that shares are only owned by individuals licensed to practice, among other stipulations.

Stock issuance isn’t just about ticking a box; it’s a pivotal step in documenting ownership lucidly and ensuring your corporation is on the right side of California’s legal framework. So, either buckle down and get acquainted with the nitty-gritty or have a seasoned attorney by your side to steer clear of any potential roadblocks.

A stock ledger acts as a meticulous record-keeper that logs crucial details about the shareholders and the shares they own in your California Accountancy Corporation. It documents the names of the shareholders, the number of shares each holds, and the date when these shares were issued.

But it doesn’t stop there; the stock ledger is your go-to document for tracking any changes in share ownership over time. Whether you’re issuing more shares in the future or there’s a transfer of shares from one individual to another, every movement gets logged in the stock ledger.

Think of it as the historical timeline of your corporation’s ownership. It’s not just a one-off document; it’s a living record that evolves as your corporation grows and changes. Each new issuance or transfer of shares gets its entry, ensuring you have a clear, up-to-date picture of who owns what in your corporation at any given time.

Having such a detailed ledger is not only about keeping things neat and organized; it’s a legal requirement that helps ensure transparency and accuracy in the ownership structure of your corporation. So, it’s something that needs careful attention and regular updating to reflect the current state of share ownership within your corporation.

A TIN, or Tax Identification Number, also known as an Employer Identification Number (EIN), serves as the corporate identity number for your California Accountancy Corporation. Issued by the IRS, it’s akin to a business version of a Social Security Number.

You’ll need the EIN for a few crucial things like opening your corporation’s bank account and filing your taxes. It’s essentially the identifier the IRS uses to track your corporation’s tax dealings.

To get your hands on an EIN, you’d fill out the IRS Form SS-4. However, if paperwork isn’t your thing, you’re in luck. The EIN can also be snagged online directly from the IRS website, which is a quicker route.

And of course, embarking on a new form-filling journey can stir up a bunch of questions. Fret not, as the IRS has a handy set of instructions for Form SS-4 where they address frequently asked questions and provide clarity on how to fill out the form correctly.

If you prefer your California Accountancy Corporation to be taxed as an S corporation, it’s necessary to file IRS Form 2553 with the IRS within 75 days from the date of formation.

The form should carry details such as the corporation’s name, formation date, address, EIN, and particulars about a representative, shareholders, along with any spouses holding a community property interest.

For further clarity on filling out the form, the IRS Form 2553 instructions provide a comprehensive FAQ section.

It’s also important that you file a Statement of Information with the California Secretary of State, and you’ve got a 90-day window from the day of incorporation to do so. If you miss this deadline, you’re looking at a suspended corporation status and a $250 penalty knocking at your door.

You’ll need to provide the name of your corporation, the entity number given by the California Secretary of State, the business address, and a mailing address if it’s different from the business address. And that’s not all – you’ll also need to list the officers, directors, the registered agent, and the type of business you’re running.

When it comes to filing, it’s a $25 fee, and if you want certified copies, that’s an extra $5. And this isn’t a one-time gig. You’ll need to file a Statement of Information annually, along with parting with another $25. So, mark your calendar to keep your corporation in good standing.

A Limited Offering Exemption Notice should be filed with the CA Dept. of Financial Protection and Innovation within 15 days issuance of stock. If the value of shares stock is less than $25,000, the filing fee is $25.

This Limited Offering Exemption Notice is essentially your way of giving the government a heads-up that you’re not selling stock to the public and exempts you from additional securities filings. It’s a small step, but one that can save you from a heap of regulatory hassles down the road.

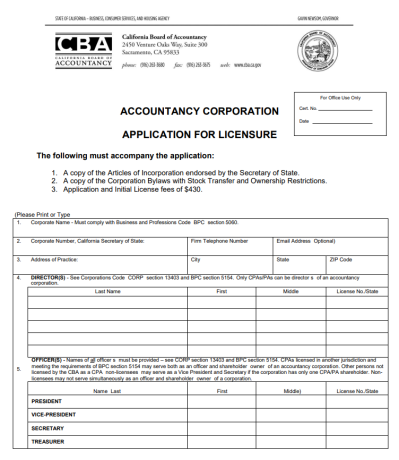

Before your Accountancy Corporation can start offering accounting services in California, it must be licensed by the California Board of Accountancy (CBA). The process begins with completing the Accountancy Corporation Application for Licensure, which comes with a $430 fee. This fee covers both the application and initial license fees.

When filling out the application, you’ll need to provide the corporate name, which must adhere to the naming guidelines set by the Business and Professions Code (BPC) section 5060. The application also requires the corporate number issued by the California Secretary of State, your firm’s contact details, and a copy of the endorsed Articles of Incorporation.

A crucial part of the application is listing the directors, officers, and shareholders. According to BPC section 5154, all directors, shareholders, and officers must hold a valid license to practice public accountancy, with a few exceptions provided in BPC section 5079 and Corporations Code (CORP) section 13403 for out-of-state shareholders and non-licensee owners.

For firms with non-licensee shareholders, additional regulations apply. The corporate bylaws must reference the restrictions on ownership and transfer of share certificates as per Title 16 of the California Code of Regulations (CCR) section 75.9 and CORP sections 13406 and 13407. Moreover, the number of licensed shareholders must outnumber the non-licensee shareholders, except for firms with only two shareholders.

Accountancy corporations must file an Application for Licensure before engaging in the practice accountancy.

Accountancy corporations must also ensure they have adequate security for claims against them by their clients, arising from professional services rendered or failure to do so. This security can take the form of insurance or a written agreement by the shareholders to jointly and severally guarantee payment of such liabilities.

The application also requires a declaration to be signed and dated by an officer who holds a valid license to practice public accounting, affirming the accuracy and completeness of the information provided.

After your corporation is licensed, remember that the license needs to be renewed every two years to remain in good standing. The renewal cycle is based on the year your application was initially approved. Renewal forms are sent out by the CBA about two months before the expiration date.

If there are any changes in your firm’s address, corporate name, or shareholders, these must be reported to the CBA within 30 days of the change. And if at any point your accountancy corporation dissolves, a Certificate of Election to Wind Up and Dissolve must be filed with the California Secretary of State, and the CBA must be informed of the dissolution.

Should you need further clarification or assistance, the Initial Licensing Unit of the CBA can be reached at (916) 561-4301 or via email at [email protected] .

Another important step after incorporating is opening a business bank account.

This account should be used, exclusively, in connection with the new accountancy corporation.

Failing to keep business and personal funds separate can trigger invalidation of the corporation in case of a lawsuit. The amount initially deposited into the corporation bank account should be reflected on the corporation’s stock ledger.

The majority of cities require corporations to obtain a local business license when operating in their city.

Check the CAlGold website to determine which licenses and permits are required for your new company.

If your accountancy corporation will be operating in the City of Los Angeles you can apply for a business license (also known as a Tax Registration Certificate) online.

It’s essential to inform all parties engaging in business with the law corporation that they are interacting with a corporate entity.

All contracts should be signed in the name of the law corporation.

Additionally, notify insurance providers about the establishment of the new corporation.

To maintain the protection offered by the corporate structure, it’s crucial to adhere to all required formalities.

Ensure to prepare corporate minutes annually and file the law corporation’s California Statement of Information each year.

Stay compliant and mark these tasks on your calendar to avoid penalties and potential invalidation of the corporation in a lawsuit.

In January of 2024, a new law, called the Corporate Transparency Act (CTA) is going into effect. The CTA requires that “beneficial ownership” be disclosed to the Dept. of Treasury Financial Crimes Enforcement Unit (FinCEN).

This means that the federal government requires you disclose who actually owns a company and who may be controlling the company behind the scenes.

The CTA’s goal is to clamp down on money laundering, tax evasion, cyber crime, terrorism and other bad acts facilitated by corporations and LLCs.

Ensure your accountancy corporation is compliant once this new law goes into effect.