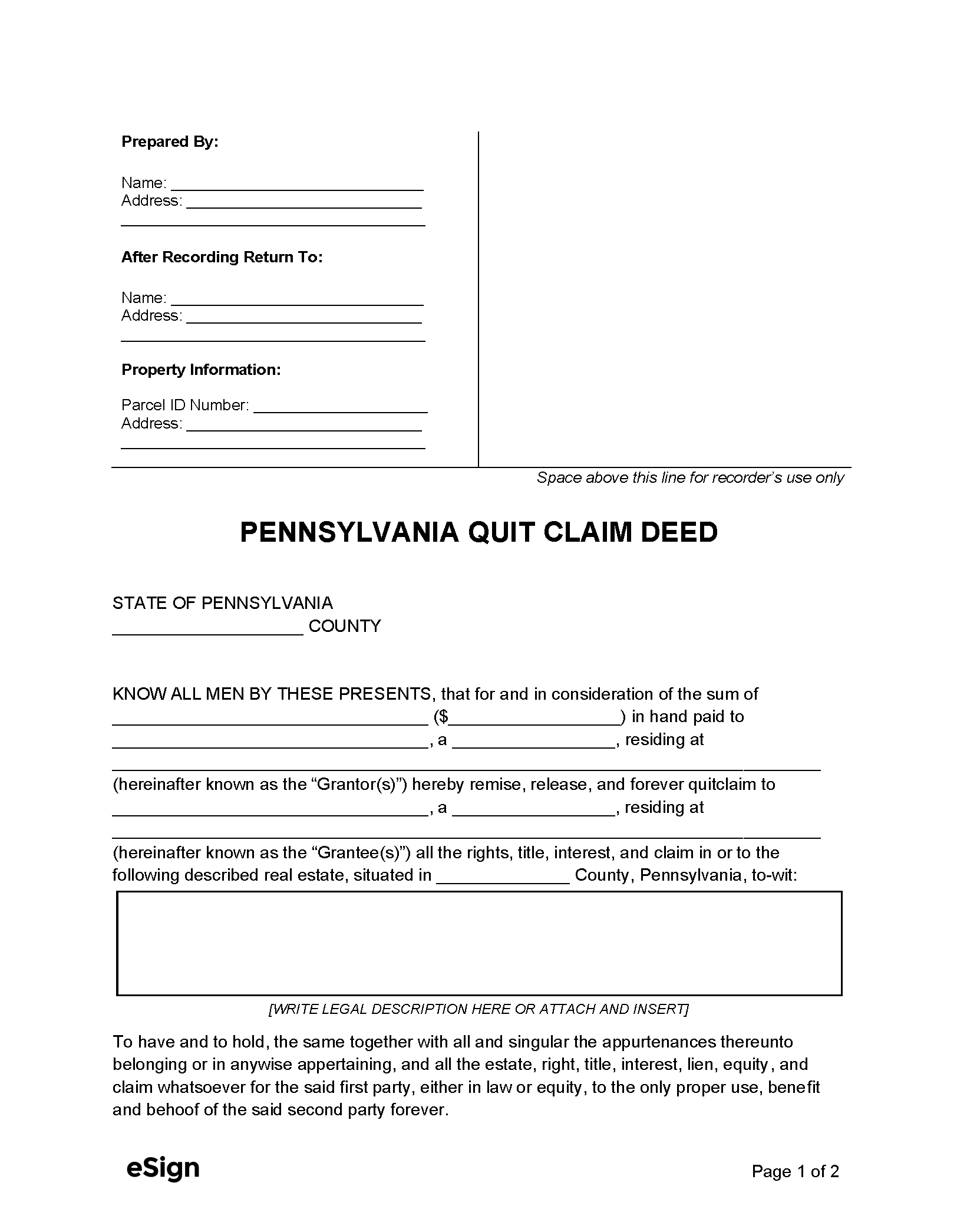

Pennsylvania Quit Claim Deed Form

A Pennsylvania quit claim deed is a form in which a grantor relinquishes all rights to a piece of real estate and transfers those rights to a grantee without title protection. What differentiates the quit claim deed from other conveyance instruments is the lack of a promise of clear title and lack of assurances regarding the legitimacy of the grantor’s ownership.

Included with the recording of a deed must be a certification of the grantee’s residential address. This certificate, found at the bottom of the deed, must be signed by the grantee or someone on their behalf. Depending on the county, the Recorder of Deeds may also require verification of the property’s parcel number from the tax assessment office.

- Statute: 21 § 7

- Formatting: Requirements vary from county to county. Individuals should contact the Recorder of Deed’s office to obtain local requirements.

- Signing Requirements (21 § 42): Notarial Acknowledgment

- Where to Record (21 § 351): County Recorder of Deeds

- Recording Fees: Approximately $80 to $100

- Exemption Statement: If the transfer is exempt from transfer taxes (e.g., family transfer), the deed should state the exemption.

- Forms:

- Property Disclosure Statement(68 § 7303): This form must be filled out by any residential property seller to inform the buyer of issues with the property that could adversely affect its value.

- Form REV-183 (Realty Transfer Tax Statement of Value) (42 § 21053): Must be filed if not paying the full market value transfer tax or if the deed does not report the full amount of consideration.

- Coal Severance Notice (52 § 1551): Deeds must include this notice if there was a coal severance below the property.

- Bituminous Coal Notice (52 § 1406.14): Must be signed by the grantees and filed with the deed when the following circumstances apply:

- Bituminous coal has been found on the premises and is being assessed for taxation separately; and

- The grantor didn’t verify whether the bituminous coal is supporting the premises.